Deal Activity

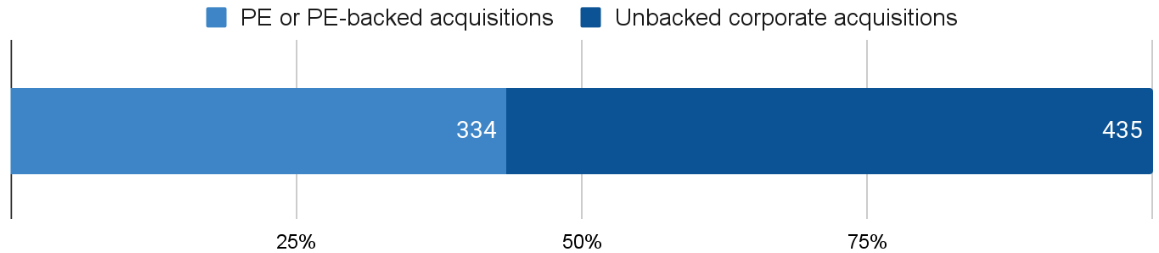

Growthink Capital Research tracked 784 closed Mergers & Acquisition transactions in March 2024 with U.S. targets, compared to the 769 tracked in February 2024.

This total includes 334 Private Equity or Private Equity-backed acquisitions and 435 by corporate acquirers.

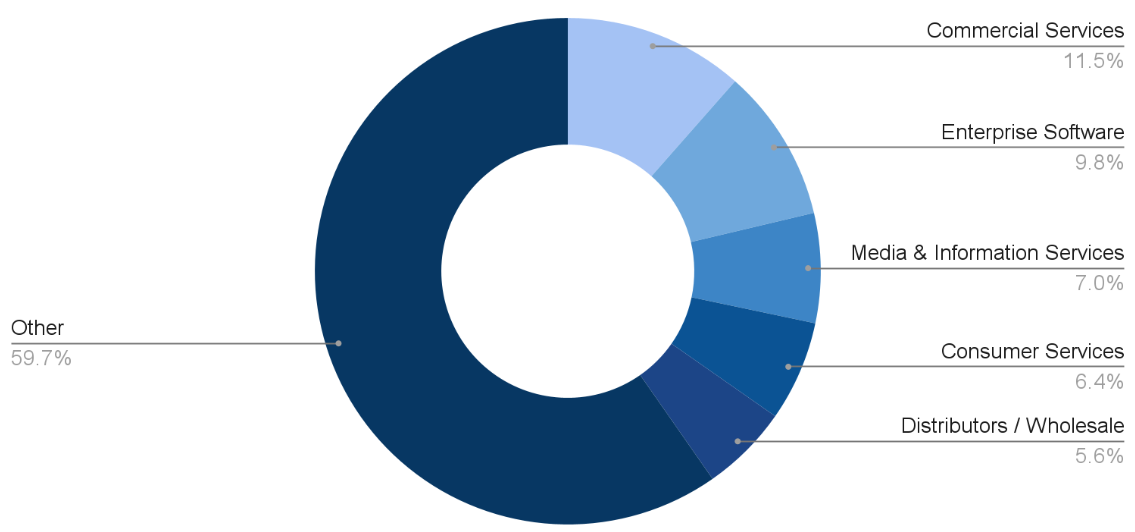

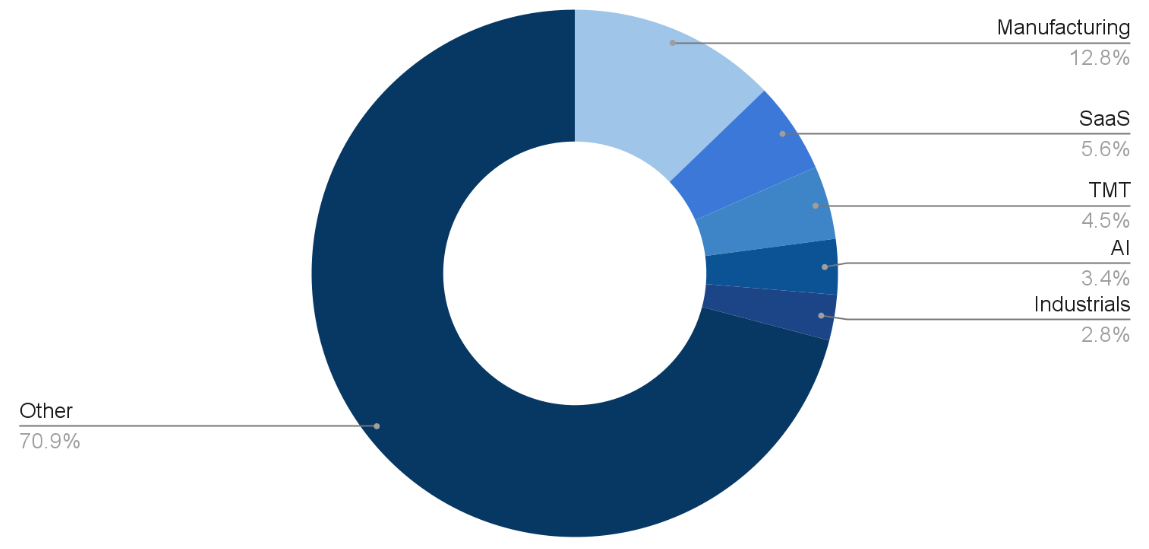

Top Industries and Segments

The top 5 associated industries by number of completed transactions were Commercial Services, Enterprise Software, Media & Information Services, Consumer Services, and Distributors / Wholesale.

The top 5 associated verticals remained consistent with those from February 2024 and were Manufacturing, SaaS, TMT, AI, and Industrials. Fragmentation remains high, with the top 5 verticals representing merely 29% of total transactions.

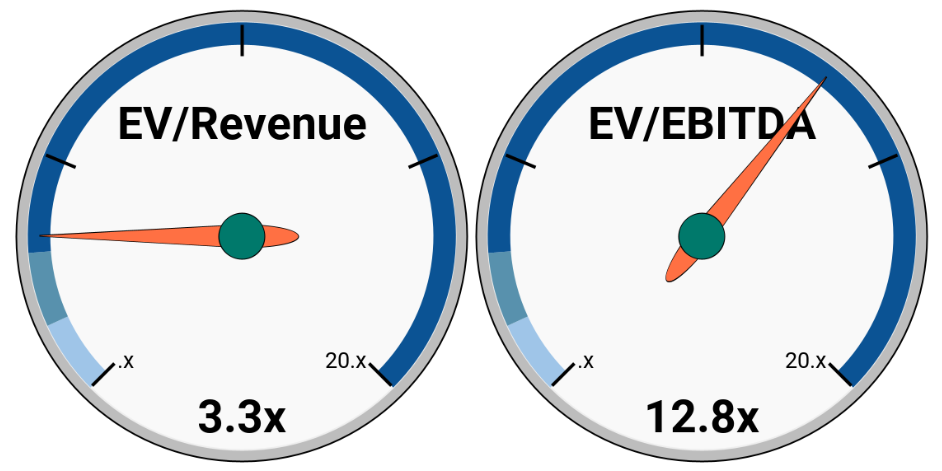

Revenue and Earnings Multiples

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a Median multiple of Revenue of 3.3x and a Median multiple of EBITDA of 12.8x (excluding negative EBITDA companies).

The median deal size has increased substantially from $92 million observed in February 2024 to $125 million in March.

The Biggest Deals

Splunk is a public cloud-first software company that focuses on analyzing machine data. The company is a major player in two markets: security, and full-stack monitoring and analysis. The San Francisco-based firm focuses on enterprise clients, with more than 90% of the Fortune 100 using its solutions.

The acquisition by Cisco Systems (NAS: CSCO) for approximately $28 billion, was announced in September 2023 and completed on March 18, 2024. The acquisition accelerates Cisco’s strategy to securely connect everything to make anything possible.

Splunk and Cisco shared far more than San Francisco as their headquarters: both companies have a strong history of acquisitions and successful integrations. After getting listed on the Nasdaq in 2012 with the ticker SPLK, Splunk acquired over a dozen companies including SignalFx, Phantom Cyber Corporation, and Caspida.

In order to stay at the forefront of cutting-edge technology, in 2020 Splunk launched Splunk Ventures, a $100 million Innovation Fund and a $50 million Social Impact Fund to invest in early-stage startups.

The Oldest and the Newest

There were 8 companies founded in the 1800s that were acquired in March 2024.

Crane Stationery is a manufacturer of paper and stationery products based in New York, United States. The company offers boxed stationery, wedding invitations, holiday cards and other personalized products.

Crane Stationery was founded in 1801 as part of Crane Currency, a global supplier of currency papers, banknote printing and anti-counterfeiting technology to central banks. As making paper for writing and for currency became more independent (with the former accounting for less than 10% of the group’s revenue), the Stationery division was spun off through a management buyout in 2015 together with the North Adams, MA factory and the Crane & Co. trademarks, and then acquired in 2018 by Mohawk Fine Papers.

Crane Stationery was acquired by WP Strategic Holdings -a private consulting and investment firm with expertise in growing small and middle market companies- through an LBO on March 14 for an undisclosed amount.

4 companies founded in 2023 and 2 in 2024 achieved an exit last month.

Lilac, an open-source software developer founded in 2023 in Boston, specializes in data understanding and manipulation for AI practitioners. Their platform enables browsing datasets with unstructured data, customizing AI models, detecting near-duplicates and personal information, and conducting semantic and keyword searches, with a focus on generative AI.

Databricks acquired Lilac on March 19, 2024, accelerating the development of production-quality generative AI applications using enterprise data.

With Databricks Mosaic AI, our goal is to provide customers with end-to-end tooling to develop high-quality GenAI apps using their own data. Lilac’s technology will make it easier to evaluate and monitor the outputs of their LLMs in a unified platform, as well as prepare datasets for RAG, fine-tuning, and pre-training. (March 19, 2024 Databricks press release)

Growthink Capital’s Transaction of the Month

Board.org is an Austin, TX-based operator of peer-to-peer communities intended for solving common problems of an organization. Founded in 1999, the company specializes in building communities focused on peer-to-peer sharing, collaboration, and support between people in similar organizations, in similar roles and with similar problems, enabling people to have confidential conversations where they help each other accomplish their mission.

The company, a subsidiary of FiscalNote Holdings, was acquired by Toronto-based Executive Platforms, via its financial sponsor Falfurrias Capital Partners, through a $95 million LBO on March 12. The company will receive a contingent payout of $8 million upon the completion of future performance terms.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please get in touch by completing this form or calling us at (213) 927-3968.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this email should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.