Deal Activity

Growthink Capital Research tracked 914 closed Mergers & Acquisition transactions in April 2024 with U.S. targets, compared to the 784 tracked in April 2024 (a 17% increase).

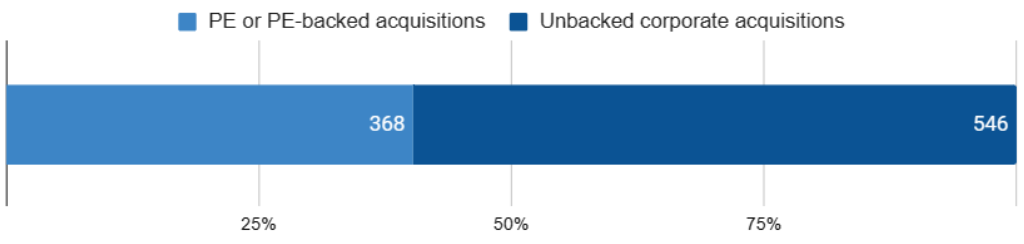

This total includes 368 Private Equity or Private Equity-backed acquisitions and 546 by corporate acquirers. For the first time, the distribution of deals is heavily skewed towards non-PE corporate acquisitions, which represented 60% of the total in April 2024.

Top Industries and Segments

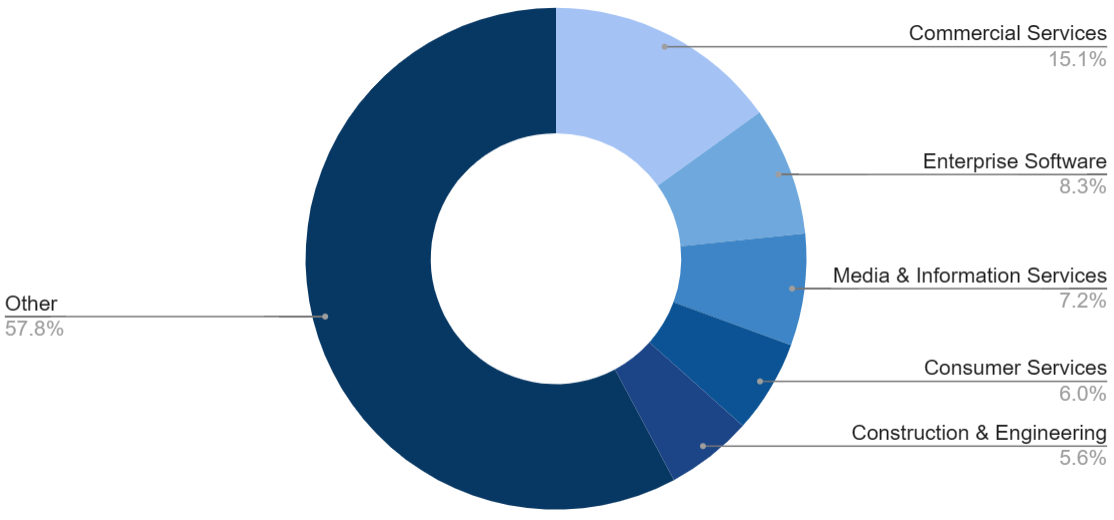

The top 5 associated industries by number of completed transactions were Commercial Services, Enterprise Software, Media & Information Services, Consumer Services, and Construction & Engineering.

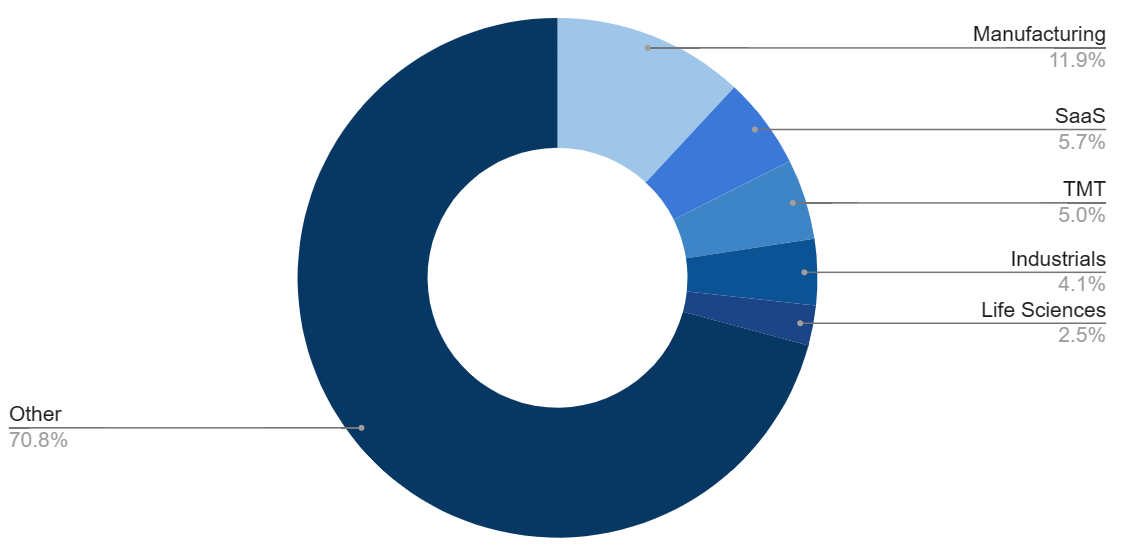

The top 5 associated verticals were Manufacturing, SaaS, TMT, Industrials, and Life Sciences. Fragmentation remains high, with the top 5 verticals representing merely 29% of total transactions.

Revenue and Earnings Multiples

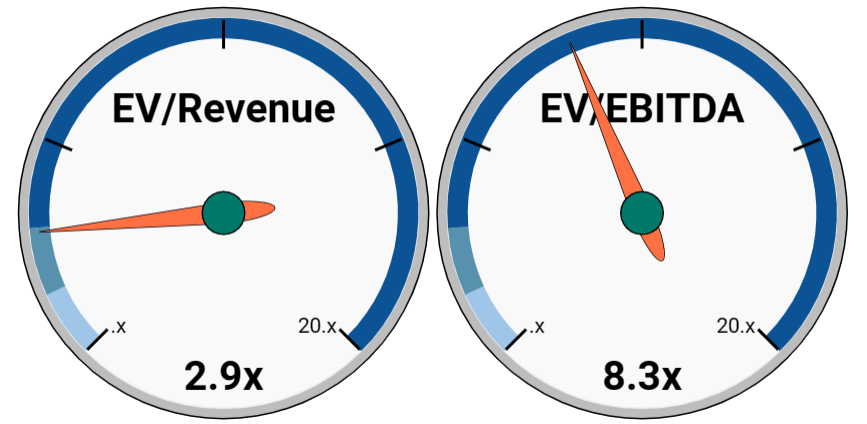

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a median multiple of revenue of 2.9x and a median multiple of EBITDA of 8.3x (excluding negative EBITDA companies).

The median deal size was $115 million, a slight drop from $125 million in March.

The Biggest Deal

NFP is a corporate benefits, insurance, and wealth management services provider serving middle-market companies, financial advisors, and high-net-worth individuals. The company operates as an insurance broker and consultant, offering property and casualty, employee benefits, life and personal insurance, and wealth and retirement planning services.

The company was acquired by Aon (NYS: AON) for $13.4 billion on April 25, 2024. This acquisition expands Aon’s presence in the large and fast-growing middle-market segment, with capabilities across risk, benefits, wealth, and retirement plan advisory.

In October 2023, NFP received $2.29 billion of development capital from HPS Investment Partners, Stone Point Capital, and other investors to be used for the acquisition of Thomas Insurance Agency. This transaction was supported by $1.67 billion of debt financing.

The Oldest and the Newest

There were 11 companies founded in the 1800s that were acquired in April 2024 (the most we’ve seen in a month’s period).

Founded in 1842, Stanley Infrastructure was acquired by Epiroc (STO: EPI A) for $760 million on April 1, 2024.

Stanley Infrastructure, a subsidiary of Stanley Black & Decker (NYS: SWK), designs, produces, and sells excavator attachments, handheld hydraulic, and battery-powered tools for infrastructure, construction, scrap recycling, demolition, and railroad applications.

This spin off will bolster Stanley Black & Decker’s focus on value creation opportunities in its core businesses while supporting its capital allocation priorities.

PharosIQ was formed on April 8, 2024, by a merger of equals between CONTENTgine – a content-driven lead generation solution provider – and Market Resource Partners – a global predictive intelligence organization and subsidiary of FD Technologies (LON: FDP).

PharosIQ provides B2B organizations with signal-driven lead generation solutions, delivering essential insights and demand to drive their sales and marketing success. The company offers content syndication, direct-to-desk mail, funnel leads, display advertising, lead generation, and custom event services, equipping B2B sales and marketing teams with the tools and insights they need to build a reliable revenue pipeline.

With this strategic move following the merger, pharosIQ embodies the realization of a shared vision, aiming to deliver unparalleled value to B2B vendors and establish itself as an industry leader.

New Mandates

The Growthink Capital team has secured an M&A mandate to lead the strategic sale for a prominent player in the passport and visa concierge services industry.

With a robust legacy spanning over thirty years, the Company has established itself as the top choice for expedited documentation needs. The Company presents an enticing investment opportunity with its rarely issued licenses, diverse B2B/B2C customer channels, and strong growth while delivering $2M+ of EBITDA.

Interested parties, or potential buyers, are encouraged to connect directly if this acquisition aligns with their objectives.

Growthink Capital’s Transaction of the Month

The operator of quick-service restaurant chain Subway has been acquired by Roark Capital Group, a private equity firm with $37 billion under management that also owns other popular F&B brands such as Arby’s, Auntie Anne’s, Baskin-Robbins, Carl’s Jr., and Dunkin’ Donuts.

The acquisition was executed through a Leveraged Buyout (LBO) for $9.55 billion and supported by $5 billion of debt financing.

Subway is a multinational American fast-food restaurant franchise specializing in sub sandwiches and wraps. The company was established by Fred DeLuca and financed by Peter Buck in 1965 as Pete’s Super Submarines in Bridgeport, Connecticut. After several name changes, it was renamed Subway in 1972. The franchise operation began in 1974 with the opening of a second restaurant in Wallingford, Connecticut. Subway has since expanded to become a global franchise with an estimated 37,000 locations in more than 100 countries (as of November 2023).

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please get in touch by completing this form or calling us at (213) 927-3968.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this article should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.