Deal Activity

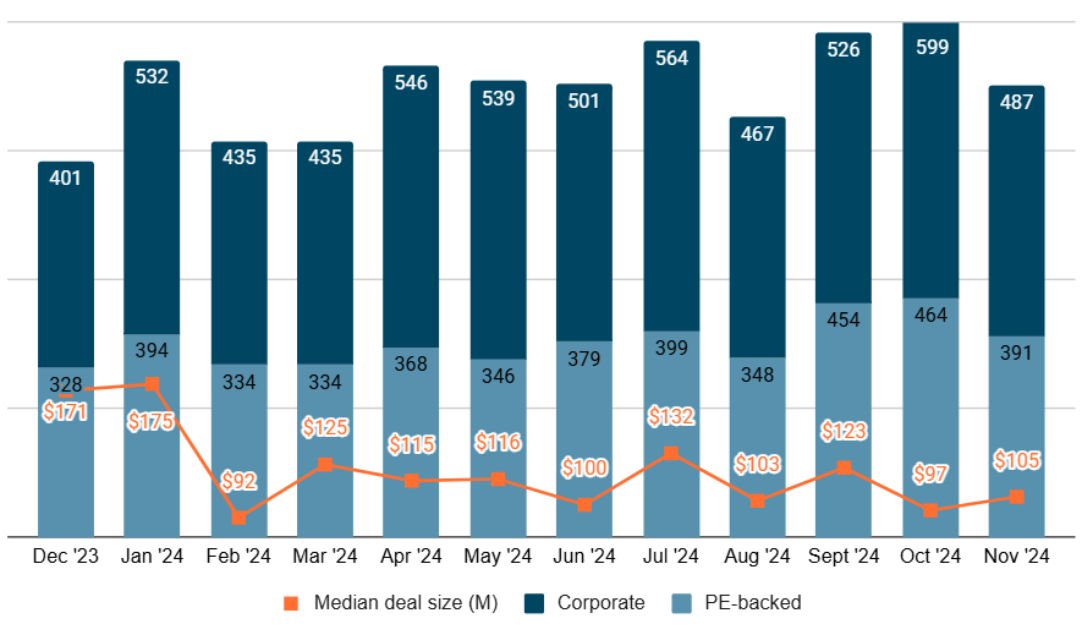

Growthink Capital Research tracked 878 closed Merger & Acquisition (M&A) transactions involving U.S. targets in November 2024, down from 1,063 in October.

This total includes 391 private equity or private equity-backed acquisitions (45% of the total) and 487 corporate acquisitions (55%).

Over the past 12 months, U.S. M&A activity consistently exceeded 750 monthly transactions, except for December 2023, which saw 739 deals. The peak occurred in October 2024 with 1,063 closed deals. In total, 10,548 M&A transactions were completed in the U.S. during this period.

Over the past 12 months, U.S. M&A activity consistently exceeded 750 monthly transactions, except for December 2023, which saw 739 deals. The peak occurred in October 2024 with 1,063 closed deals. In total, 10,548 M&A transactions were completed in the U.S. during this period.

Private equity accounted for 4,539 transactions (an average of 378 per month), while corporate acquirers closed 6,009 transactions (an average of 501 per month). Corporate buyers consistently dominated, with a 57% share of total deals over the last 12 months.

Median monthly transaction values exceeded $100 million in all months except February and October, peaking at $165 million in January and dipping to $92 million in February.

Revenue and Earnings Multiples

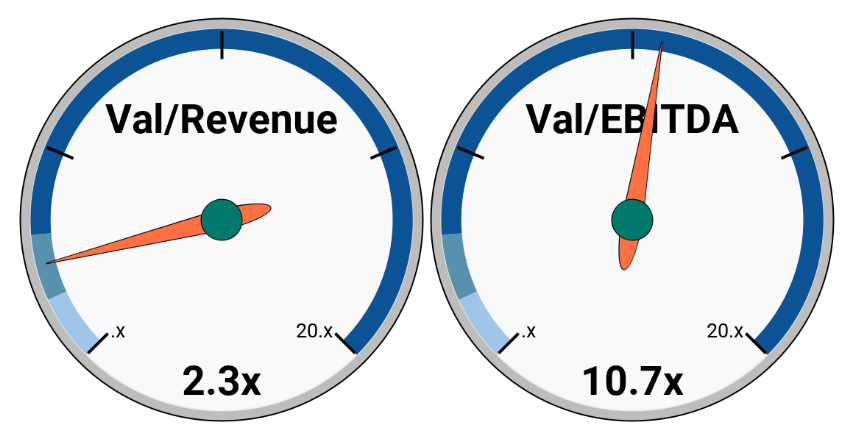

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a median valuation multiple on revenue of 2.3x and a median EBITDA multiple of 10.7x (excluding negative EBITDA companies).

The median deal size was $105 million, with an average of $1,017 million due to the 18 reported transactions in excess of $1 billion.

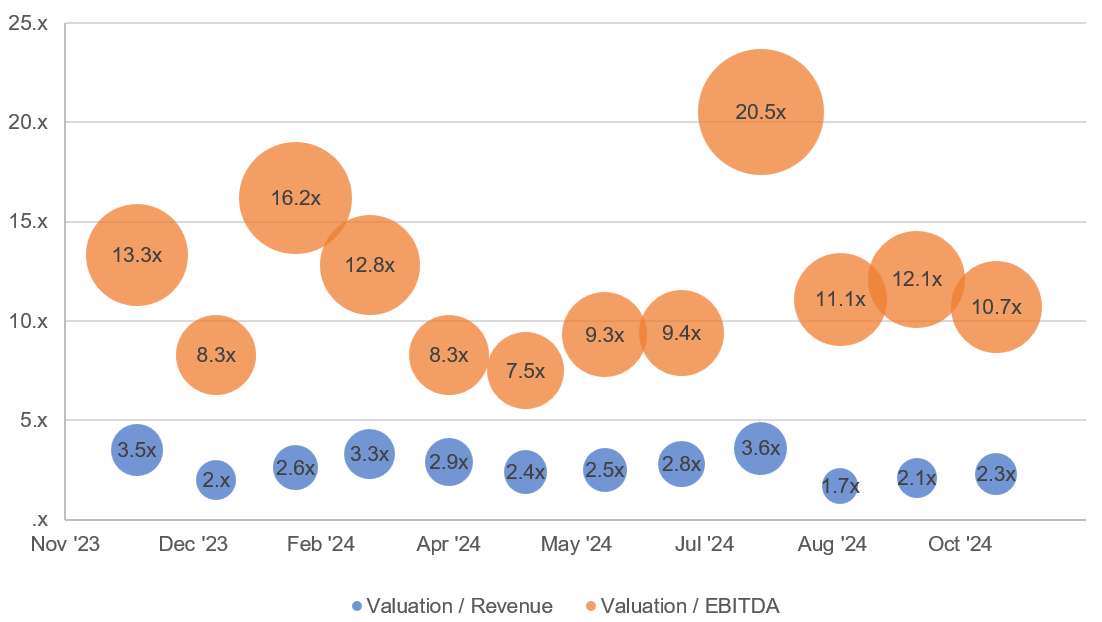

Over the past 12 months, valuation multiples for M&A deals varied significantly. EBITDA multiples ranged from a low of 7.5x in June to a high of 20.5x in September. The median monthly EBITDA multiple exceeded 11.0x in 6 of the last 12 months.

Revenue multiples showed less fluctuation during the same period, ranging from a high of 3.6x in September to a low of 1.7x in October. Revenue multiples were above 2.5x for half of the year.

The Biggest Deal

Beyond ConocoPhillips’ (NYSE: COP) $22.5 billion acquisition of the 1887-founded Marathon Oil, the largest transaction in November 2024 was the $9 billion acquisition of Primo Brands Corp by BlueTriton Brands, a deal that had been announced earlier in June.

Primo Brands Corp, a North American beverage company specializing in healthy hydration, offers a diverse range of sustainably sourced products across various formats, channels, and price points. Distributed throughout the U.S. and Canada, the company is a leader in reusable packaging, promoting waste reduction through multi-serve bottles and innovative packaging materials, including recycled plastic, aluminum, and glass.

The transaction is set to create a leading North American pure-play healthy hydration company. BlueTriton Brands, backed by financial sponsors One Rock Capital Partners, Metropoulos & Company, Farol Asset Management, and CFT Capital Partners, acquired Primo Brands via an LBO on November 8, 2024, for $9 billion.

2024 was a prolific year for major mergers and acquisitions, including Cisco’s $28 billion acquisition of Splunk in March, Exxon’s $64.5 billion acquisition of Pioneer Natural Resources in May, Home Depot’s $18.25 billion acquisition of SRS Distribution in June, Mars’ $36 billion acquisition of Kellanova in August, and Diamondback Energy’s $26 billion acquisition of Endeavor Energy Resources in September.

Growthink Capital’s New Mandates

We are collaborating with a large U.S. operator actively seeking to acquire B2B services businesses across a wide range of verticals. Examples include tree and landscaping services, continuing education, professional services, and more.

Backed by substantial resources, this operator is focused on acquiring asset-light businesses with a minimum EBITDA of $1 million.

If you own or know of a company that fits this profile and are interested in exploring this opportunity, please by completing this form or call us at (213) 927-3968.

Top Industries and Verticals

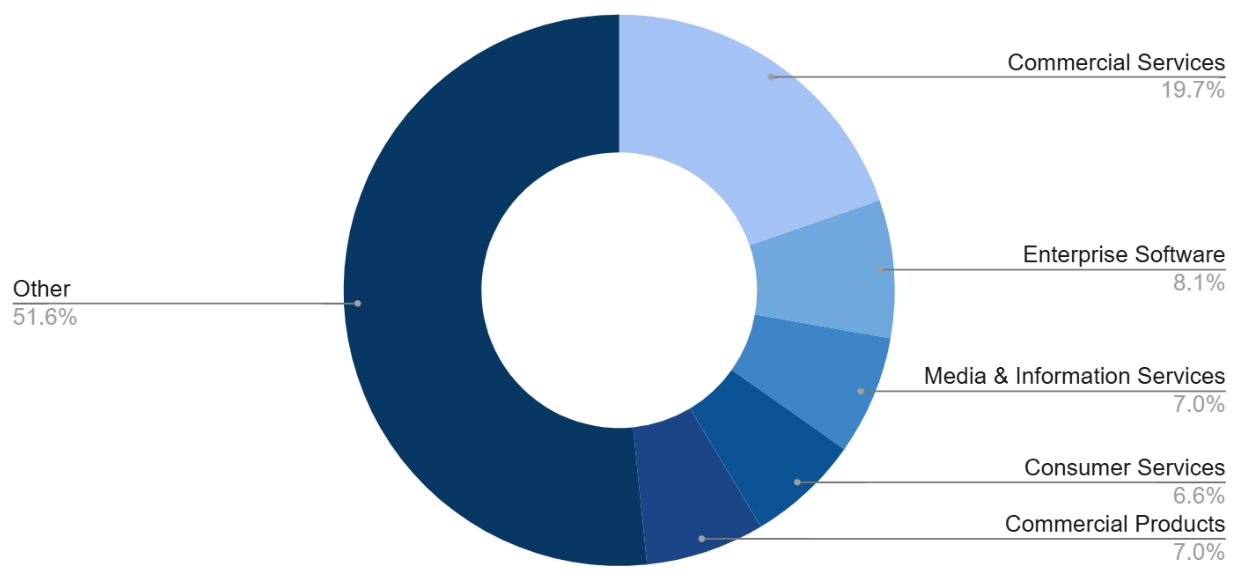

Approximately half of the completed transactions were in 5 industries: Commercial Services, Enterprise Software, Media & Information Services, Consumer Services, and Commercial Products.

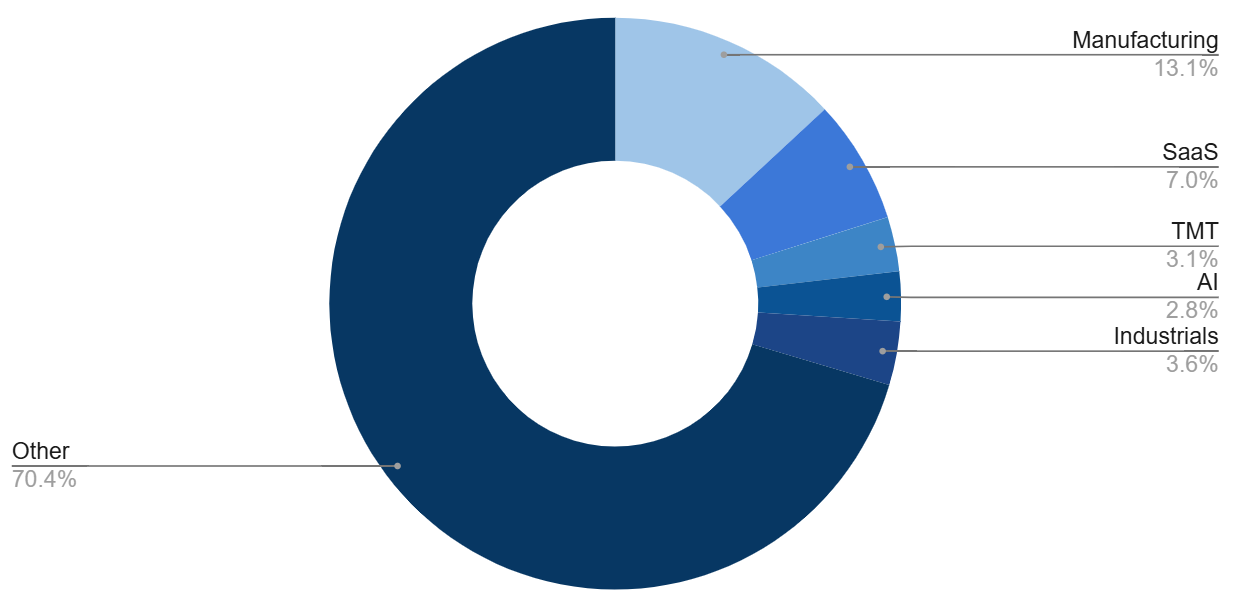

The top 5 associated verticals were Manufacturing, SaaS, TMT, AI, Industrials. Fragmentation remains high, with the top 5 verticals representing merely 30% of total transactions.

The Oldest and the Newest

In November 2024, 14 companies founded in the 1800s were acquired. Among them was the acquisition of 1867-founded The Watkins Company by Cannae Holdings.

The Watkins Company is a producer and retailer of food products based in Winona, Minnesota. The company’s product line includes extracts, flavors, organic spices, seasoning mixes, dips, baking decorations, cooking spray, and natural food coloring, enabling clients with food products made from natural ingredients.

The company was acquired by Cannae Holdings (NYS: CNNE) and KDSA Investment Partners for an undisclosed amount on November 11, 2024. Cannae Holdings acquired 53% in the company for $80 million. This strategic investment aims to leverage the strengths of both Cannae and KDSA to drive growth and innovation for Watkin’s fast-growing portfolio of flavoring products including spices, seasonings extracts.

At the same time, 18 companies founded or spun off between 2023 and 2024 saw exits, including Supermaven, the AI coding assistant developer, was acquired by Anysphere, creator of the Cursor code editor, for an undisclosed amount. Announced on November 12, 2024, the deal aims to integrate Supermaven’s technology into Anysphere’s Tab AI model, enhancing its ability to handle long code sequences. “We can build a more useful product, faster, together” said Anysphere CEO Michael Truell.

Founded by Jacob Jackson, Supermaven launched in February 2024, attracting 35,000 developers and raising $12 million from top investors like Bessemer Venture Partners and OpenAI co-founder John Schulman. Jackson noted the merger will enable co-designed models and UI to unlock new capabilities.

The acquisition comes as Anysphere, reportedly valued at $2.5 billion, strengthens its position in the $27 billion AI coding tools market projected by 2032.

Given the nature of the transaction, this image was created using artificial intelligence.

Growthink Capital’s Transaction of the Month

Worldpac is a distributor of advanced auto parts specializing in the import and distribution of OE and high-quality aftermarket replacement parts for independent service centers. The company’s products ensure a precise fit, easy installation, and exceptional quality to maintain vehicle integrity. Additionally, Worldpac offers highly regarded technical and business training, enhancing its value proposition for customers.

A subsidiary of Advance Auto Parts, Worldpac was acquired by The Carlyle Group through a $1.5 billion leveraged buyout (LBO) in November 2024. The transaction included $725 million in debt financing.

Based on the company’s reported $2.1 billion revenue and $100 million EBITDA as of June 2024, the deal implies a valuation multiple of 0.71x revenue and 15x EBITDA.

The original Advance Store on South Jefferson Street in Roanoke, VA. In April 1932, Arthur Taubman purchased the Advance Stores from Pep Boys, including two in Roanoke and one in Lynchburg, VA, and built the Advance Auto Parts empire, parent company of Worldpac.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please get in touch by completing this form or calling us at (213) 927-3968.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this article should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.