Deal Activity

Growthink Capital Research tracked 1,063 closed Merger & Acquisition transactions in October 2024 with U.S. targets, a substantial increase from the 980 tracked in September 2024.

This total includes 464 Private Equity or Private Equity-backed acquisitions (44% of the total) and 599 corporate acquisitions (56% of the total).

Revenue and Earnings Multiples

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a median valuation multiple on revenue of 2.1x and a median EBITDA multiple of 12.1x (excluding negative EBITDA companies).

The median deal size was $96.5 million, with an average of $744 million due to the 23 reported transactions in excess of $1 billion.

The Biggest Deal

Epicor Software, a leader in enterprise solutions for ERP, supply chain, and HR management, Epicor helps businesses enhance efficiency and competitiveness.

The company was acquired by CVC Capital Partners through an LBO estimated at $4 billion, valuing Epicor at $8 billion. This follows a $3.57 billion debt refinancing in May. Epicor’s robust platform continues to deliver value across industries, driving its market prominence.

Growthink Capital’s New Mandates

A leading operator in residential, commercial, and industrial power solutions is actively pursuing U.S. and international acquisitions in energy innovation. The buyer is seeking companies specializing in areas such as:

- Eco-Friendly Energy Storage Systems (eg. BESS)

- Energy Management System

- Microgrid Controllers

- Fuel Cell Technology

- IoT-Enabled Industrial Equipment for data monitoring and control

- EV charging technology

This strategic acquirer typically executes deals in the $20 million–$200 million range, though alignment with the buyer’s vision can outweigh financial metrics. Ideal targets offer innovative technologies that enhance energy reliability, functionality, and sustainability.

If you operate or know one such company and are interested in exploring this acquisition opportunity, please get in touch by completing this form or by calling us at (213) 927-3968.

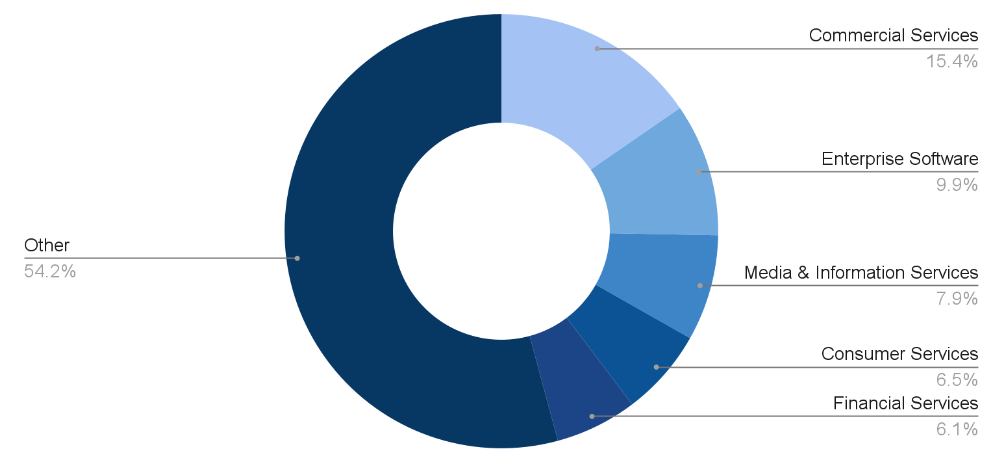

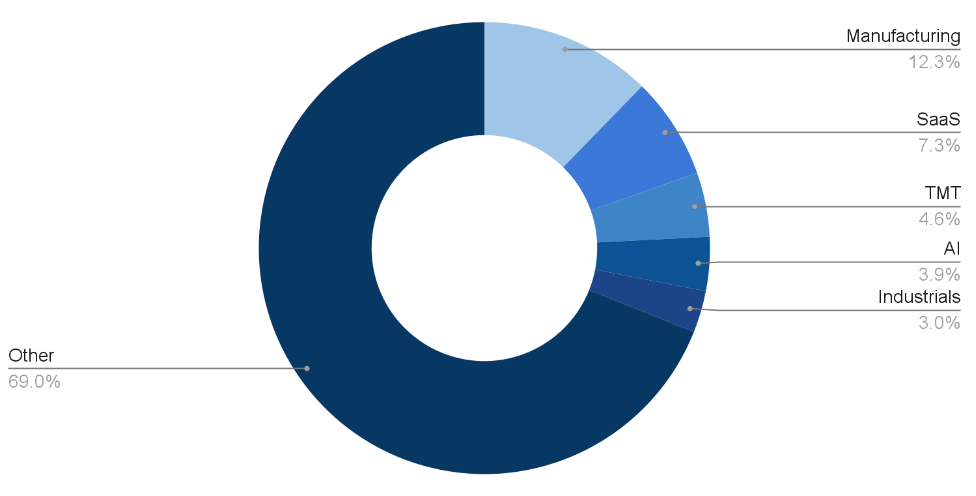

Top Industries and Verticals

Approximately half of the completed transactions were in 5 industries: Commercial Services, Enterprise Software, Media & Information Services, Consumer Services, Financial Services.

The top 5 associated verticals were Manufacturing, SaaS, TMT, AI, Industrials. Fragmentation remains high, with the top 5 verticals representing merely 30% of total transactions.

The Oldest and the Newest

In October 2024, 7 companies founded in the 1800s were acquired. Founded in 1869, Alabama Industrial Distributors began as a leather and harness shop in Oxford, Alabama, before evolving into a trusted provider of safety, MRO, and power transmission solutions serving industrial, construction, institutional, and governmental markets. In October 2024, the company was acquired by Turner Supply Company, a leading industrial supply distributor established in 1905. This acquisition strengthens Turner Supply’s presence in Eastern Alabama and enhances its offerings with expanded MROP brands, e-commerce, vending, and kitting services. Turner Supply’s shared values and resources position both companies for growth while honoring Alabama Industrial Distributors’ 155-year legacy of reliability and innovation.

At the same time, 9 companies founded or spun off between 2023 and 2024 saw exits, including Aerodome. Established in May 2023, Aerodome, a trailblazer in drone-first responder platforms, is revolutionizing missions in law enforcement, disaster response, and search-and-rescue. Its tech powers autonomous drones to assess 911 call scenes, saving time and enhancing safety.

Flock Safety acquired Aerodome for over $300 million last month, making it one of public safety’s largest tech deals. The acquisition fuels Flock’s expansion into police drones, with plans to roll out its own fleet and hire 100 engineers. Both companies, backed by a16z, are reshaping public safety through AI-driven innovation.

Growthink Capital’s Transaction of the Month

Zeta Global (NYSE: ZETA) acquired LiveIntent, a people-based marketing pioneer, for $250M, reflecting a revenue multiple of 3.29x and EBITDA multiple of 16.13x.

This acquisition bolsters Zeta’s AI-powered marketing platform with LiveIntent’s data assets, publisher network, and omnichannel capabilities. CEO David Steinberg highlighted the strategic synergy, promising expanded margins and enhanced offerings for enterprise clients. The move strengthens Zeta’s foothold in personalized marketing and its drive toward greater direct-channel revenues.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please get in touch by completing this form or calling us at (213) 927-3968.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this article should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.