Deal Activity

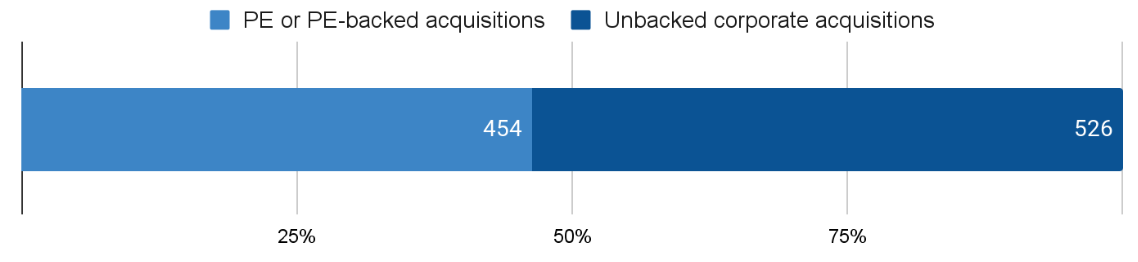

Growthink Capital Research tracked 980 closed Merger & Acquisition transactions in September 2024 with U.S. targets, a 20% increase from the 815 tracked in August 2024.

This total includes 454 Private Equity or Private Equity-backed acquisitions (46% of the total) and 526 corporate acquisitions (54% of the total).

Revenue and Earnings Multiples

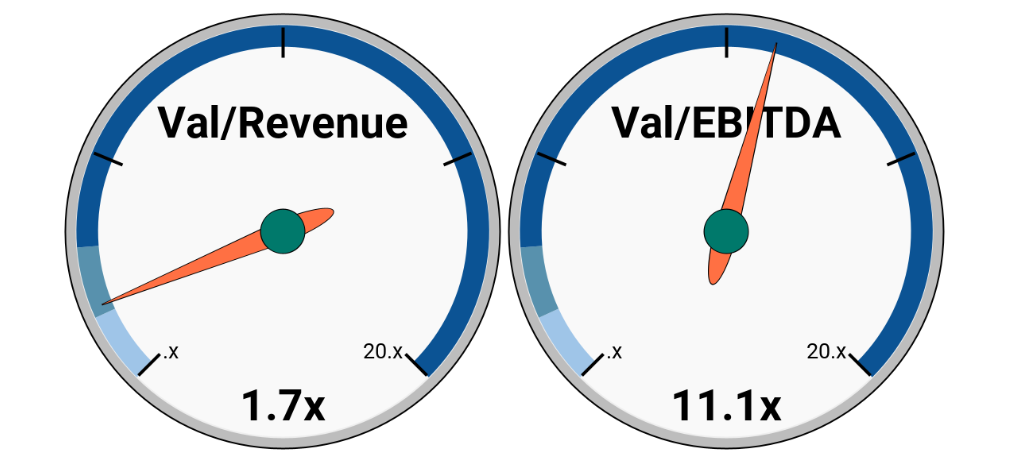

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a median valuation multiple on revenue of 1.7x and a median EBITDA multiple of 11.1x (excluding negative EBITDA companies).

The median deal size was $123 million, with an average of $828 million due to the 16 reported transactions in excess of $1 billion.

The Biggest Deal

In a transformative $26 billion deal, Diamondback Energy (NAS: FANG) has acquired Endeavor Energy Resources, a key oil and gas drilling company focused on the Midland Basin. Endeavor Energy Resources offers a range of services, including pulling units, roustabout crews, water hauling, welding, and gas transportation. The transaction consists of 117.3 million shares of Diamondback common stock and $8 billion in cash, positioning Diamondback as a leading player in the Permian Basin, the largest oil patch in the U.S.

Growthink Capital’s New Mandates

Growthink Capital is seeking acquisition opportunities for a Pet Care Platform focused on omni-channel pet products, including pet food, treats, supplements, grooming products, dental care items, and waste solutions. The target companies can include branded products, private-label, or contract manufacturing operations. The buyer, majority-owned by a large investment firm, requires that the acquired company be U.S.-based with a minimum EBITDA of $1 million.

If you’re interested in exploring this acquisition opportunity, please call us at (213) 927-3968.

Upcoming Webinar Invitation – Effortless Valuation Boost: Adding Millions Without Changing a Thing

Are you ready to increase your business’s value effortlessly? Join us on October 31st at 11 a.m. PST for our webinar, ‘Effortless Valuation Boost,’ featuring Eddie Clay, a seasoned expert with over 25 years of experience in banking and finance. Having been involved in over $1B worth of transactions for lower and middle-market companies, Eddie will reveal the proven strategies top businesses use to add millions to their valuation without making major changes.

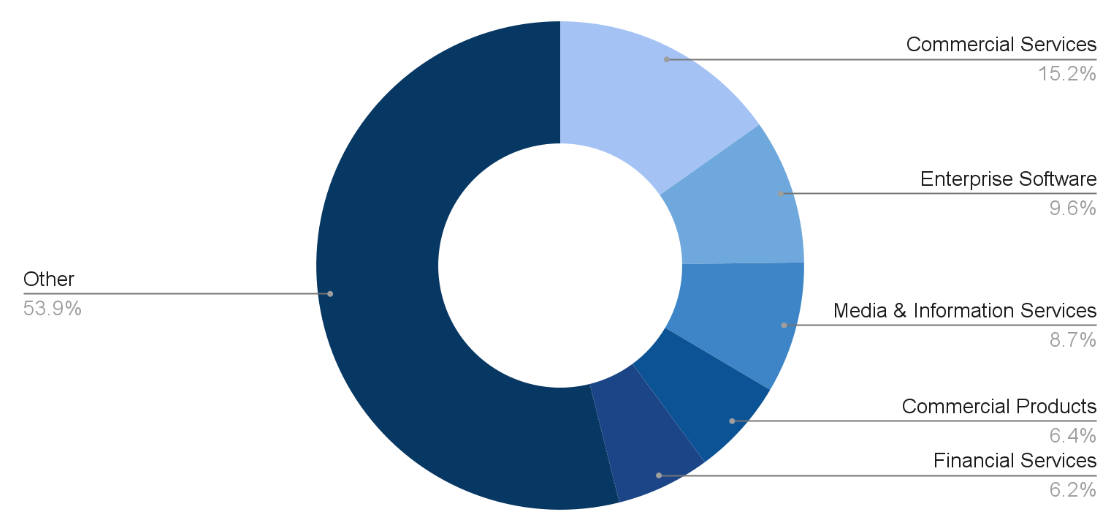

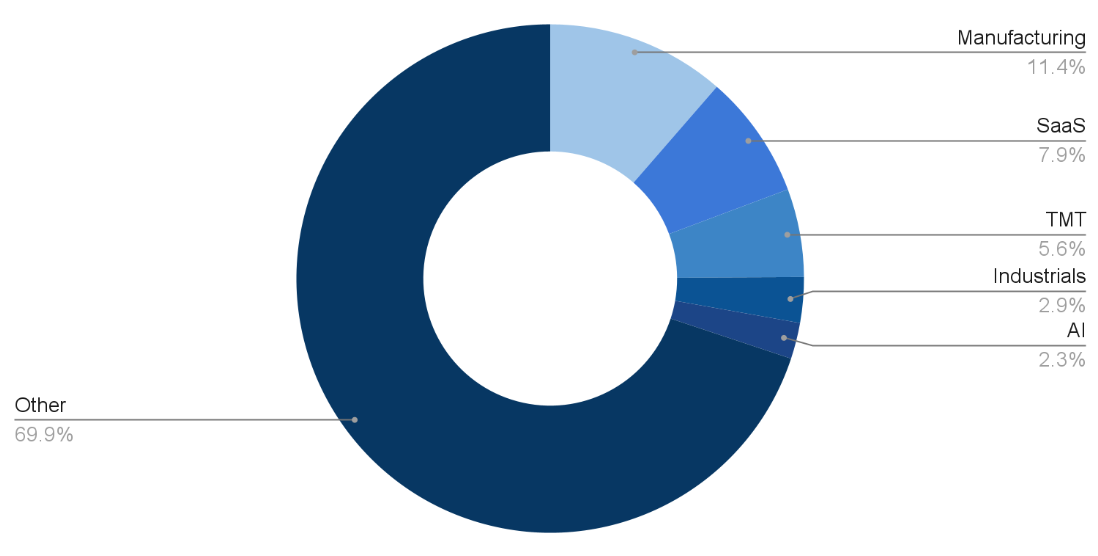

Top Industries and Verticals

Approximately half of the completed transactions were in 5 industries: Commercial Services, Enterprise Software, Media & Information Services, Commercial Products, and Financial Services.

The top 5 associated verticals were Manufacturing SaaS, Industrials, TMT, Cybersecurity. Fragmentation remains high, with the top 5 verticals representing merely 30% of total transactions.

The Oldest and the Newest

In September 2024, eight companies founded in the 1800s were acquired. Among them was Woodstock Heating & Cooling, established in 1849. The company provides heating, ventilation, and air conditioning (HVAC) services for residential and light commercial properties, specializing in air conditioning installation, heating repair, and indoor air quality solutions. LightBay Capital acquired the company through a leveraged buyout (LBO) for an undisclosed amount, continuing its long legacy of serving local communities.

At the same time, 19 companies founded or spun off between 2023 and 2024 saw exits, including Erudite Wealth Management, which offers personalized wealth management services to high-net-worth individuals. Kestra Financial, backed by Warburg Pincus and Oak Hill Capital, acquired Erudite via an LBO in September 2024.

Growthink Capital’s Transaction of the Month

Battea Class Action Services, a provider of intelligence and claims management services for banks, hedge funds, asset managers, sovereign funds, and other investors, was acquired by SS&C Technologies (NAS: SSNC) for an estimated $670 million.

Battea specializes in settlement recovery, litigation research, case tracking, trade data mining, claim filing, and award distribution, offering comprehensive support through all stages of settlement claims related to antitrust and securities litigation.

The deal’s valuation multiples, based on Battea’s last reported financials, were 11.0x revenue and 21.5x EBITDA.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please get in touch by completing this form or calling us at (213) 927-3968.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this article should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.