Deal Activity

Growthink Capital Research tracked 815 closed Merger & Acquisition transactions in August 2024 with U.S. targets, an 18% decrease from the 963 tracked in July 2024.

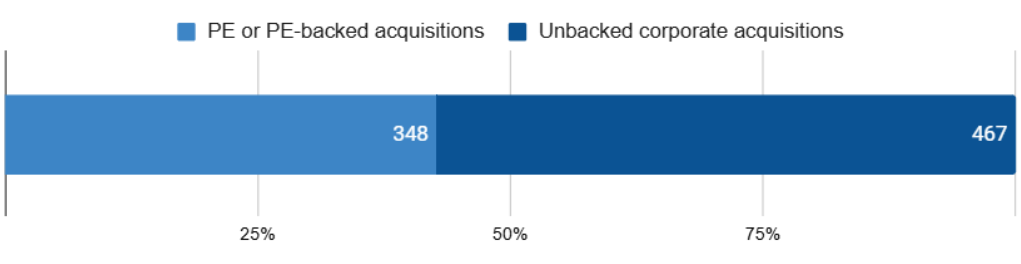

This total includes 348 Private Equity or Private Equity-backed acquisitions and 467 corporate acquisitions. The distribution of deals continues to be skewed towards non-PE corporate acquirers, which represented 57% of the total.

Top Industries and Verticals

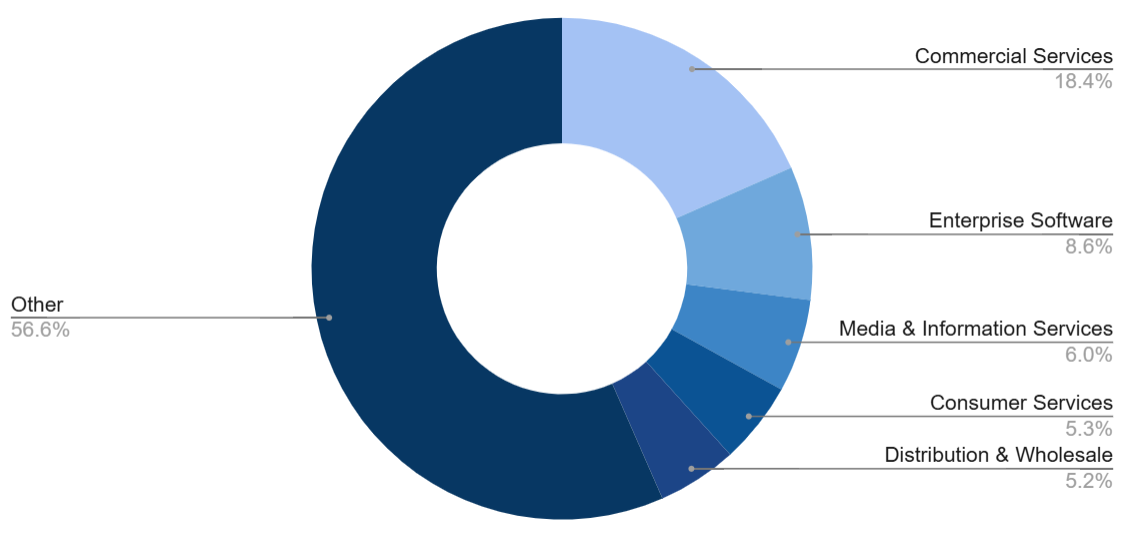

The top 5 associated industries by number of completed transactions were Commercial Services, Enterprise Software, Media & Information Services, Consumer Services, IT Consulting & Outsourcing.

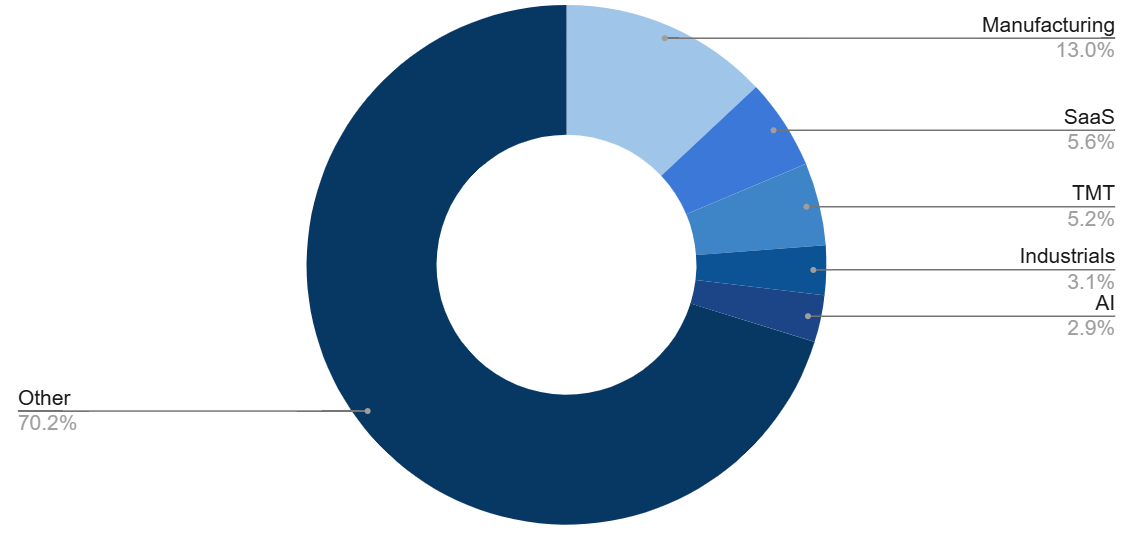

The top 5 associated verticals were Manufacturing SaaS, Industrials, TMT, Cybersecurity. Fragmentation remains high, with the top 5 verticals representing merely 30% of total transactions.

Revenue and Earnings Multiples

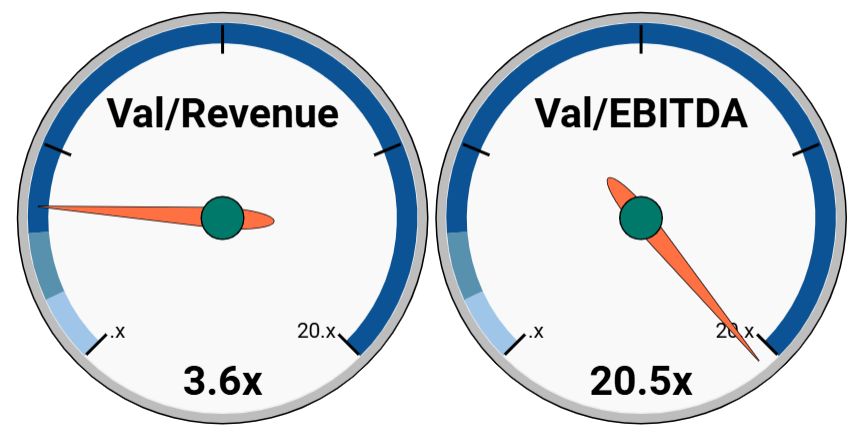

From the transactions that disclose the valuation as well as revenue and/or EBITDA information, Growthink Capital derived a median revenue multiple of 3.6x (a 28% increase from 2.8x in July) and a median EBITDA multiple of 20.5x (a 118% increase from 9.4x in July, both excluding negative EBITDA companies).

The median deal size was $102.5 million, returning to the levels observed before the $132 million peak recorded in July.

The Biggest Deal

The largest transaction in August was the acquisition of Kellanova by Mars for $35.9 billion.

Following its split from the North American cereal business in October 2023, Kellanova (previously the global snacking arm of Kellogg) has operated as a leading global manufacturer and marketer of salty snacks, snack bars, frozen breakfast fare, meat alternatives, and other packaged foods with brands such as Pringles, Cheez-It, Rice Krispies Treats, Pop-Tarts, Eggo, Nutri-Grain, and MorningStar Farms.

Its offerings are manufactured in around 20 countries and marketed in more than 180 countries, with non-U.S. sales account for about half of Kellanova’s consolidated sales base.

The acquisition enables Mars to significantly expand its Snacking platform, allowing it to even more effectively meet consumer needs and drive profitable business growth.

Growthink Capital’s New Mandates

Growthink Capital is exploring the strategic sale of a leading integrated market research solutions provider serving the top global consulting firms and marketing firms across 50+ geographies.

The company generated $10.6 million in revenue and $3.0 million in adjusted EBITDA (29% margin) in 2023, with a forecasted to close 2024 with $13.0 million in revenue and $4.1 million in adjusted EBITDA (31% margin).

The company is opportunistically open to majority acquisitions by a strategic buyer that can maximize its assets and proprietary technologies.

If you’re interested in exploring this acquisition opportunity, please reply to this email or call us at (213) 927-3968.

The Oldest and the Newest

There were 7 companies founded in the 1800s that were acquired in August 2024.

Hammacher Schlemmer began as a hardware store in New York City in 1848, specializing in unique tools. It became one of the first to mint its own coins during the Civil War due to a coin shortage.

Over time, the company introduced numerous firsts, including the pop-up toaster and electric toothbrush. By 1881, it had launched a catalog, which grew to 1,112 pages by 1912. After over 100 years of family ownership, it was sold in 1953. The company was among the pioneers in online retailing, launching its website in 1998, and remains known for innovative products today.

The company was acquired by S5 Equity through an LBO on August 10, 2024 for an undisclosed amount.

Meanwhile, 8 companies founded, created, or spun off between 2023 and 2024 achieved exits last month.

Arena Renewables is a community and distributed solar and storage developer across the U.S. The company delivers lower power bills and clean energy, thereby using a policy-led approach to develop valuable projects.

The company was acquired by Crestwood Energy, via its financial sponsors Ground Squirrel Ventures, Manulife Investment Management, Ripple Impact Investments, CleanCapital, and BlackRock, through an LBO on August 26, 2024 – less than 12 months from its launch!

Growthink Capital’s Transaction of the Month

Micromeritics Instrument Corporation, the world leader in particle, powder, and porous material characterization systems, was acquired by Spectris (LON: SXS) for $683 million on August 23, 2024.

Micromeritics’ technology portfolio includes pycnometry, adsorption, particle size analysis, and catalyst activity testing, with R&D and manufacturing sites in the USA, UK, and Spain. Its systems are used in over 10,000 labs across leading companies, government agencies, and academic institutions globally.

Spectris, a UK-based precision instrumentation and controls supplier, is listed on the London Stock Exchange and part of the FTSE 250 Index. The company’s major platforms include Malvern Panalytical, HBK, Omega Engineering. Known for its strategic acquisitions such as Concept Life Sciences, Servomex, Concurrent Real-Time and SciAps Incorporated, Spectris continues to expand its portfolio with Micromeritics, further strengthening its presence in high-performance material analysis.

With Micromeritics reporting $117 million in revenue and $35 million in EBITDA as of December 2023, the acquisition price of $683 million reflects an estimated 5.8x valuation/revenue multiple and a 19.5x valuation/EBITDA multiple.

To explore M&A alternatives for your business – whether that be pursuing a sale of the company, liquidity for shareholders, or growth-by-acquisition opportunities – please get in touch by completing this form or calling us at (213) 927-3968.

Securities transactions are conducted through GT Securities, Inc. Member FINRA/SIPC. Nothing in this article should be regarded as an offer to sell or a solicitation of an offer to buy any Investment.